In most cases, a business needs to collect sales tax in the states in which they are located. This concept, called nexus, means that if the business has a physical presence in a state, that state can compel the business to collect sales tax from its customers. Nexus is pretty cut-and-dry when you’re thinking about the place where you work, or your business headquarters.

If you’re a brick-and-mortar store with a single location, this is pretty straightforward. Everyone who comes into your store should pay your local sales tax rate on purchases (not accounting for topics like exempt sales and buyers). If you have multiple locations, it’s still not too bad – each physical store charges sales tax at the rate where that store is located.

Many companies do more than sell products from their own physical store, though, and those other activities can also create a nexus. Some of these activities may not be so obvious. If your business does any of the following, you should look further into the activity and see if perhaps you need to collect sales tax for other states as well.

Activity #1: Traveling Salespeople

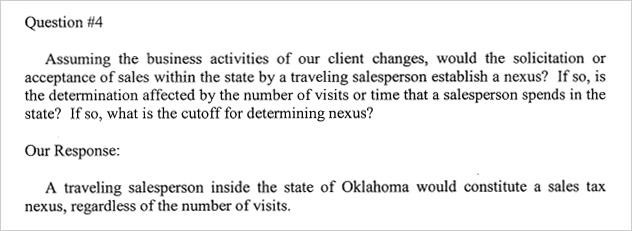

In almost all cases, having a salesperson who travels into a state and makes transactions will generate a nexus for your company in that state. Consider the following question-and-answer from the state of Oklahoma:

Source: Oklahoma Tax Commission

Based on the laws of Oklahoma, one salesperson can make one sale within the state for a single penny, and that transaction will create nexus for the company, meaning that all of their sales to Oklahoma, even if made through other means than the salesperson, become taxable.

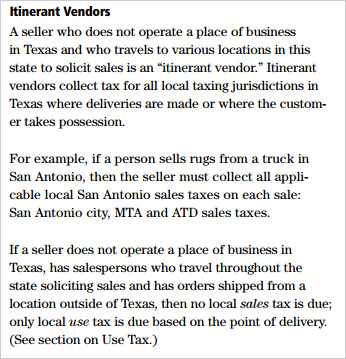

For a more complicated example, let’s take a look at Texas’s guidelines for traveling salespeople:

Source: Texas Comptroller of Public Accounts

Beginning on page 5 of this document, there is a section about what Texas sales tax rate to use for sales made by traveling salespeople for Texas businesses. However, as a Texas business, this company already has nexus so they would have an obligation to collect sales tax regardless. The more appropriate section of the document begins on page 6 under the heading “Itinerant Vendors”. By definition, an Itinerant Vendor is any company who does not operate a place of business in Texas, but who has traveling salespeople who solicit orders within the state. In this case, the sale is taxable if a delivery is made by the company or if the customer takes possession of the items. However, if the items are shipped to the customer from a location outside Texas, sales tax is not due – but use tax is.

Activity #2: Fulfillment House

Some e-commerce retailers maintain their own inventory and ship from their own warehouse, but others may use a third-party company known as a fulfillment house. The fulfillment house warehouses the retailer’s inventory (all or partial) and is responsible for receiving new shipments from vendors and packing and shipping orders to the retailer’s customers. If your business uses an out-of-state fulfillment house, you may have a nexus in the fulfillment house’s state and be required to collect sales tax on all orders made to customers in that state.

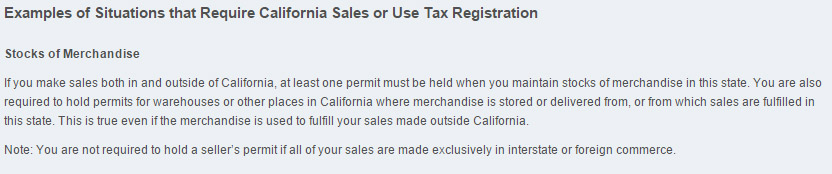

Source: California State Board of Equalization Publication 77

The above example comes from the state of California and applies to businesses who maintain “stocks of merchandise” within the state of California – exactly what happens with a fulfillment house relationship. As long as you are making sale(s) within the state of California, your use of a fulfillment company who stores your merchandise within the state means you have a nexus there, and you need to collect sales tax on California-based orders.

One other thing to consider: Let’s say you are a Minnesota business with two fulfillment houses, one in Wisconsin and another in California. A customer in California purchases from your website. For whatever reason, the order is filled from your Wisconsin warehouse instead of the one in California. You are still liable to collect sales that from the customer, due to the fact that you have a fulfillment house in California.

Activity #3: Drop-Shipping

Drop-shipping is an activity where the end customer places an order for goods with a retailer, who then orders those goods from the vendor (manufacturer or distributor). Then retailer doesn’t maintain inventory of those goods; they are shipped directly from the vendor to the final customer. The customer pays the retailer, and the retailer in turn pays the vendor.

Should sales tax be collected?

It depends. First of all, talk to your vendor about whether they will charge you sales tax. If so, you’ll usually want to pass that cost along to your customer. However, since this transaction between you, the retailer, and your vendor, is a wholesale transaction, tax is typically not charged as long as you maintain a resale certificate on file. It varies, though, so you’ll want to check with each vendor you use for drop-shipping.

The bigger question is whether the relationship between you, the retailer, and the vendor creates a nexus – which would require that ALL transactions to customers in the drop-shipper’s state to become taxable, even if some of those orders are not drop-shipped. The laws are nuanced, but specifically in Florida, Texas, California, and New York, it’s possible that this creates a nexus for your business.

The following screenshot from Publication 121 outlines the drop-shipper relationship and the requirements for collecting sales tax, as well as which company incurs the liability.

Source: California State Board of Equalization Publication 121

Activity #4: Affiliates

The past few years have seen a flurry of activity relating to affiliate programs and sales tax. It all started in 2008 in the state of New York, where they enacted what became known as “The Amazon Law”. It applied to affiliates, or to use their language, businesses with a “click-through” arrangement. An affiliate program is where you recruit outside marketers – often bloggers, but also sometimes pay-per-click gurus and/or email marketers – to promote your business or products. They are given a special code to append to links, and when a customer follows an affiliate’s link to reach the retailer’s website and makes a sale, the affiliate earns a commission.

The New York sales tax law gives retailers a nexus if they had one or more affiliates in the state of New York who generated at least $10,000 in combined sales within the state over the past 12 months. Other states soon followed then trend, and as such, many retailers have either banned affiliates from affected states (unless the retailer already had a nexus there), or have had to begin collecting sales tax on sales made within those states.

Another term you may hear for affiliate-based sales tax is click-through nexus.

Activity #5: Trade Shows

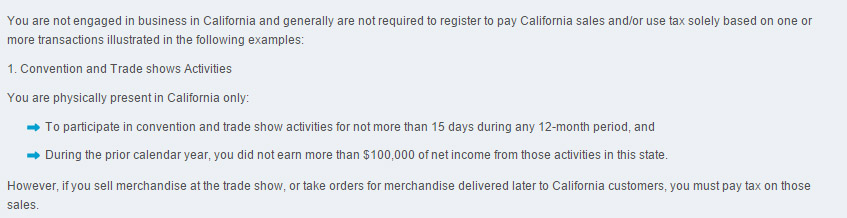

The last activity we’re going to look at is participation in trade shows or conventions in states where you don’t otherwise have a nexus. In many states, making sales or taking orders for taxable goods at a trade show means that you have to collect sales tax on those orders. Other states are more specific. For example, California’s Publication 77 states gives certain thresholds for number of days of trade show participation and amount of sales generated by trade shows; if your business operates under those thresholds, you do not have a nexus, but any sales made at the show itself are subject to sales tax.

Source: California State Board of Equalization Publication 77

However, in Florida, participation in a trade show requires you to register to collect sales tax unless your agreement states that you are prohibited from making sales. It doesn’t matter whether you actually make a sale or not.

Source: Florida Department of Revenue, Sales and Use Tax on Trade Show and Convention Exhibitors

Summary on Nexus Creating Activities

As you can see, a variety of business activities can open your company up to sales tax liability in states other than the primary state(s) where you maintain your offices. Depending on your participation in these or other activities in additional states, you may be advised to seek legal counsel or discuss with the state taxation departments about any sales tax liability.

![Why is Sales Tax Considered a Regressive Tax? [Infographic]](https://www.accuratetax.com/wp-content/uploads/2017/03/sales-tax-regressive-tax-infographic-768x576.jpg)