Have you ever heard the term “regressive tax”? Maybe not. It refers to a tax that is unfairly imposed more strongly on lower income families.

Is Sales Tax Regressive?

You may be wondering: is sales tax progressive or regressive?

Sales tax is regressive, in fact. Why? Because people who earn less pay a larger percentage of their salary in the form of sales tax, as compared to those who earn more.

In fact, based on percentage of salary, people in the lowest bracket pay more than DOUBLE what the top 1% pay. Because everyone in a given area pays the same percentage of tax, it works out to be a larger portion of the overall income for people who earn less.

Compare that to income tax, where (not counting deductions), the rich pay a higher percentage than the poor. Income tax is called a “progressive tax”, because the burden falls more strongly on those who earn more.

You may wonder if there’s a middle ground. There is – it’s called a “proportional tax”. That’s where everyone pays the same percentage of what they earn. In other words, a flat tax. Note that this is the same percentage of what they spend – which is exactly how sales tax works. It’s the same percentage of earnings.

For a more in-depth look, see our post Is Sales Tax Fair?, published in 2016. It still applies today.

Regressive Taxes Examples

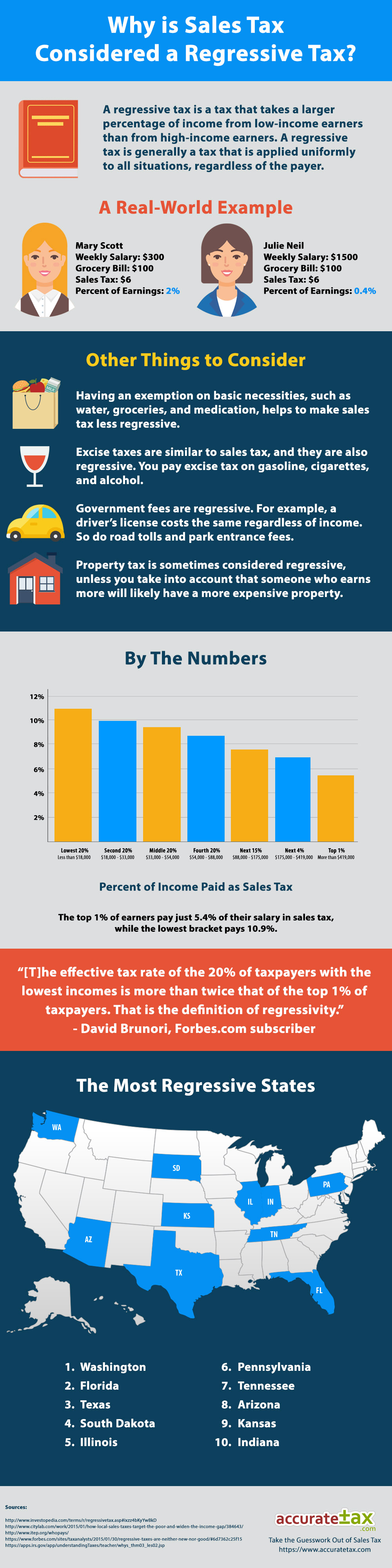

We’ve made an infographic below to help you understand what a regressive tax is. If you compare Mary and Julie in the example below, you’ll see that sales tax has a much larger negative effect on Mary than it does on Julie. Mary spends 2% of her earnings on sales tax, while Julie spends only 0.4% of her earnings. This sales tax infographic also explains the burden that sales tax carries, and which states are the most regressive. (Hint: avoid Washington and Florida!)

Facts to Tweet

- The top 1% of earners pay just 5.4% of their salary in sales tax, while the lowest bracket pays 10.9%. [tweet this]

- Washington, Florida, and Texas have the most regressive tax systems among all states. [tweet this]

- Exemptions on basic necessities, such as groceries and medication, makes sales tax less regressive. [tweet this]

Embed This Infographic

Share this infographic on your website or blog. Simply paste in the code from the box below to publish it to your site.